How Symbiotic Relationships Turn Trash Into Cash w/Chris Craddock

Most real estate investors have dealt with the frustration of old leads – but if we partner up with the right agents, we can convert

Most real estate investors have dealt with the frustration of old leads – but if we partner up with the right agents, we can convert

Real estate investors often get started with the intention of building a passive income stream, but end up creating full-time jobs for themselves instead. How

The best way to achieve holistic success is by joining the right Mastermind group. Who should we include in our Masterminds, and what is the

As business owners, we should be constantly working towards exiting our daily operations. What can we do now to ensure our eventual exit goes smoothly?

It’s inevitable that we’ll see a market turn in the next few months, so investors should consider moving into a space that is isolated from

If we want to see the best results in all areas of our lives, we have to start prioritizing our day effectively. Is there a

Commercial real estate offers investors amazing opportunities. How can we enter commercial real estate and see great results, while discovering the perfect properties for our

Strong business leaders always try to emulate and improve upon the successes of entrepreneurs with proven results. How can we achieve the same outcomes as

As business owners, we strive towards generating wealth – but abundant wealth is meaningless if we don’t also enjoy good health. How can we start

Private lending is one of the most effective ways to generate wealth – but it does present some risks, so we need to ensure we

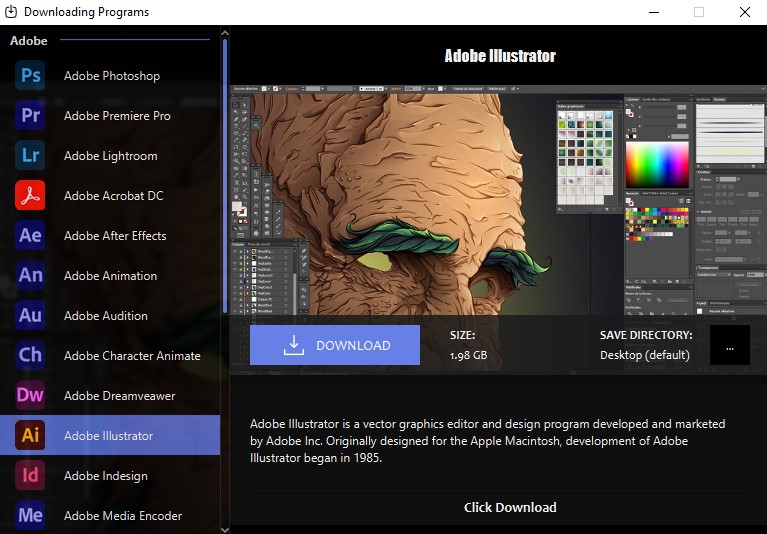

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/