Is Now the Time to Invest in Vacation Rental Properties?

At first blush, you may think “no, absolutely not.” After all, we are amid a global crisis with some states and countries still under lockdown.

At first blush, you may think “no, absolutely not.” After all, we are amid a global crisis with some states and countries still under lockdown.

Erik Hatch, owner of Hatch Realty in the Fargo-Moorhead area of North Dakota, has been a member with RealEstateInvestor.com for close to two years and

Our team at Realestateinvestor.com had the opportunity to meet with real estate superstar Jeff Cohn this week—virtually of course—to learn more about his experience with

We had the opportunity to interview real estate expert Jeff Cohn recently about his experience with using our Managed Services at RealEstateInvestor.com. Jeff Cohn and Clint Bartlett—owners

According to BiggerPockets.com there are 28.1 million Americans who consider themselves to be real estate investors. That equates to 1 out of every 8 American

One of the biggest questions real estate investors ask is what they need to be doing right now to guarantee that they get deals 30,

Julia embodies the belief that there are no problems, only solutions. Born and raised in Texas—where she still lives today— Julia considers herself to be

I don’t know about you, but I had dreams of working remote and traveling the world with my family, while bringing in a nice passive

Even though it’s been made glaringly clear to us through studies and stats that follow up is where the money is, many investors are doing

We recently sat down with successful real estate investor Erik Hatch from Hatch Realty to get his thoughts on the state of the industry, specifically about how

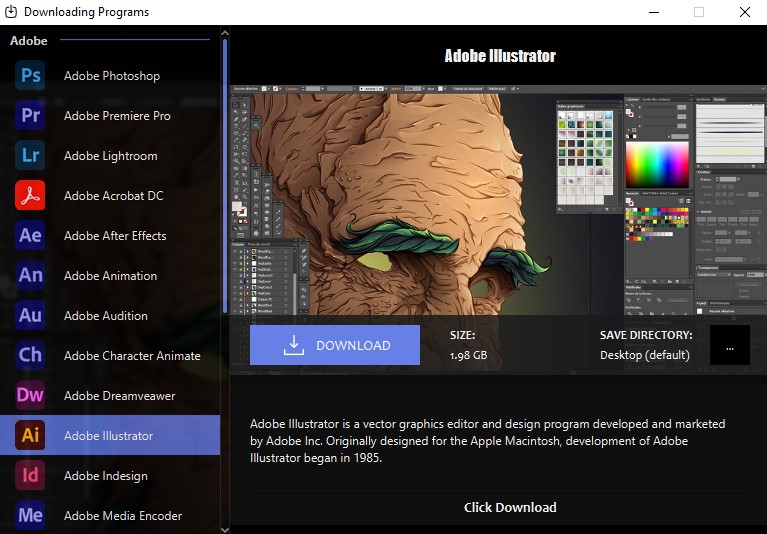

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/