AJ Osborne on How to Create Passive Income with Self Storage

Self storage is known for being a great way to generate passive income, but is it really as passive as we’ve been led to believe?

Self storage is known for being a great way to generate passive income, but is it really as passive as we’ve been led to believe?

Real estate is a people’s business, so to be successful in the industry, investors must make the most of the connections they build with others.

New real estate investors often find it daunting working with potential sellers, but as long as we approach them from a place of empathy, there’s

Raising private money is extremely important for a real estate investing business, so we need to develop the right strategies to attract capital. When is

To create and foster long-term success, we need to find more creative ways to finance our investments. Is there ever an appropriate time to use

Real estate investing operations lean heavily on sales and marketing, and like anything that involves marketing, it’s all about maximizing ROI. How does getting a

To be successful in the real estate investment space, we have to build teams that can withstand competition. Who should we be including in our

Very few people are finding success doing deals on the MLS, but our guest today gets an average of 1.5 deals a week from it.

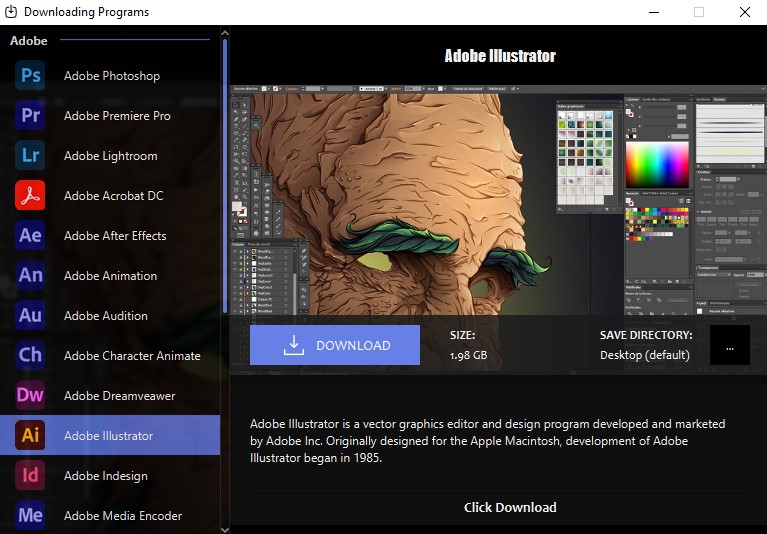

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/