Land Keller & Rhet Langley, TK Investments Group, LLC.

When they’re not saving lives, these two doctors are building their real estate business. Find out how Land and Rhet utilized our Done-For-You Services to

When they’re not saving lives, these two doctors are building their real estate business. Find out how Land and Rhet utilized our Done-For-You Services to

Marketing is the lifeblood of a successful real estate investing operation. When we stop marketing, people stop knowing what we do and we throw a

The most effective and successful marketing campaigns for real estate investors don’t happen by chance – they are the result of the right data, the

To scale our operation, generate more leads, and grow our income, we have to learn, own and know a local market. But what happens when

Wilts Alexander is a Performance Coach in our REInvent Coaching Program where he helps real estate entrepreneurs embrace their roles as CEO’s of their business,

Scaling an investing operation is a bold move, but it’s one worth making. There are personal and business risks involved in scaling but they shouldn’t

In this industry, we talk about marketing and generating leads, but if we can’t consistently convert those leads into profitable deals, we can become frustrated.

Closing more deals allow us to increase our profitability and scale our investment operation, and investors are always looking for the next best tactic to

Last month, Google announced a planned update to their Personalized Advertising Policies specific to Housing, Employment, and Credit ads, effective October 19th, 2020. Google’s new

As the founder of RealEstateInvestor.com, Gary Boomershine is on a mission to revolutionize the real estate industry and reinvent how real estate entrepreneurs do business

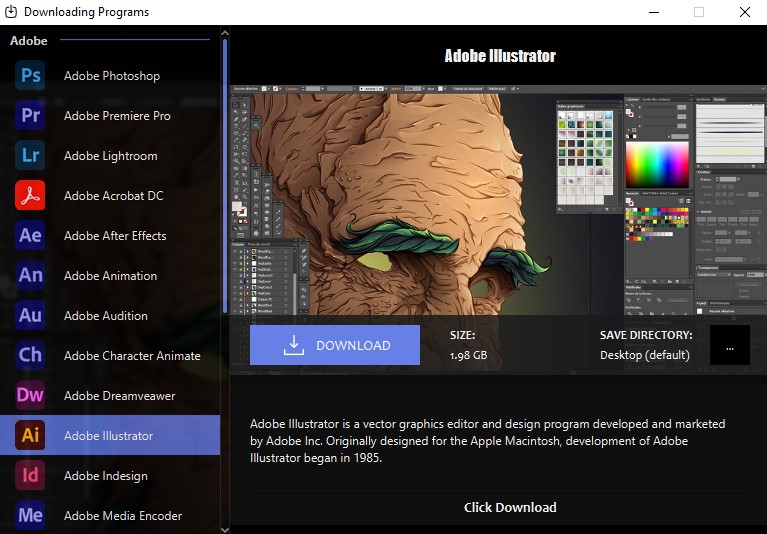

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

Notifications