Real Estate Investors Need To Save For A Rainy Day

As a kid, I heard the phrase “save for a rainy day,” every time I wanted to spend my allowance on candy. I’m sure I

As a kid, I heard the phrase “save for a rainy day,” every time I wanted to spend my allowance on candy. I’m sure I

Seems hard to believe the global economy could be shut down overnight…Yet it happened. There’s no wonder then why people are speculating about how the

To say Gary Boomershine, founder of RealEstateInvestor.com, is passionate about real estate is an understatement. We were fortunate enough to talk with him today about

We’ve been talking about it from the early days of COVID-19… It was the driving catalyst for our building Real Estate Investor Beacon, a 100% Free

You spent hours researching the market, finding the perfect neighborhood, and property with just the right amenities and all within your budget. You’ve got your

Successful people know about the Law of 33%. Whether it’s referred to as the Law of 33% or the 33% Rule, the concept is still

The real estate market changes every few years. Sometimes motivated sellers are coming out of the woodwork, and other times they’re super hard to find.

If you’re ready to build your financial wealth, consider the following There are many ways to grow wealthy during a recession as a real estate

At first blush, you may think “no, absolutely not.” After all, we are amid a global crisis with some states and countries still under lockdown.

According to BiggerPockets.com there are 28.1 million Americans who consider themselves to be real estate investors. That equates to 1 out of every 8 American

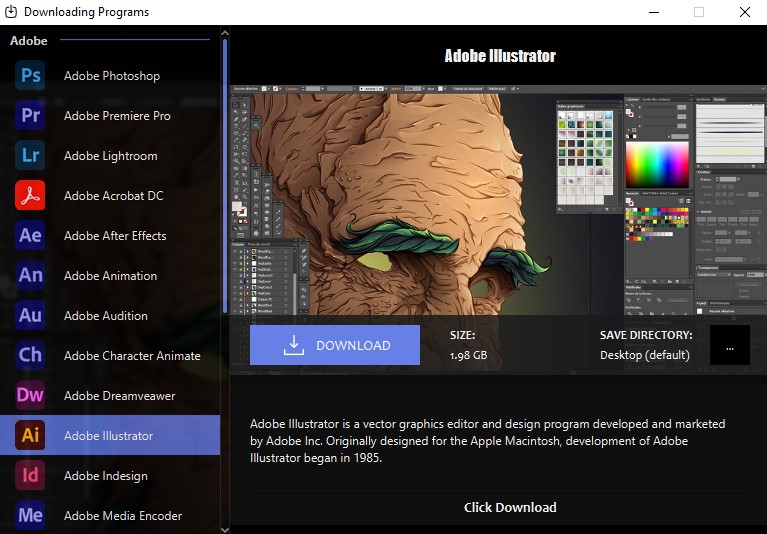

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/