At first blush, you may think “no, absolutely not.” After all, we are amid a global crisis with some states and countries still under lockdown.

This uncertainty can stall you from looking toward the future when travel restrictions are lifted, and life and business return to some normalcy.

During a crisis, it is not uncommon for people to make decisions out of panic. When bookings drop, some existing property owners may feel desperate and opt to sell at a lower price than they should. Lenders may offer lower interest rates during these economic downturns or have properties available as a short sale.

All of which could make this the perfect time to invest in vacation rental property.

But like other investing opportunities, it’s best to make your decision based on facts and data.

Booking sites such as Airbnb, VRBO, and others have made finding properties for today’s traveler much easier. With the increase in travelers preferring vacation homes over hotels, an investment in rental property is a wise decision with the potential for a great return on your investment.

Before diving in headfirst, consider realistic drawbacks.

Count the costs before buying a vacation rental property. Here are some of the questions you should ask yourself first.

Can you afford it?

Verify your finances to make sure this investment fits within your budget. Strapping yourself for cash is not a wise decision during any economic climate.

What if no one rents your property?

It’s a worst-case scenario that no one wants to think about. Perhaps the location is undesirable, or the price is too high, or the property is too small, or the area is facing another economic crisis. Whatever the reason, would you be able to weather the storm if you went without rental income for several weeks or perhaps even months?

Remember that this is also your investment.

Choose a location and property you and your family will enjoy. Perhaps if it’s not rented for a few weeks out of a year, you all could travel there and build great memories. Either way, the property would still be useful if it’s somewhere you could benefit from traveling to.

If owning a vacation rental property sounds appealing, where do you begin?

If you’ve counted the costs and decided that you’re ready to make this investment happen, here are some ideas of where to start.

For starters, do your research.

Location is key to a successful vacation rental investment. Choose a destination that attracts travelers. Properties in warm climates or with access to beaches and amenities may be popular. But properties near parks, lakes, or other attractions may have a similar draw. Apartments or lofts in metropolitan cities or cottages in mountainside towns may be equally appealing.

Once you’ve narrowed down your location, research properties for sale. Analyze market rates to ensure a good return on your investment.

When searching for rental property, keep these things in mind:

- Does the property need repairs like a new roof or windows?

- In what condition are the appliances and heating/cooling systems?

- What will repair or renovations cost, and how long will they take?

- Why is the current owner selling?

- What types of renters did they have in the past?

- What enhancements can you make to attract more renters?

Consider all actual costs.

Besides the initial investment, furnishings, repairs, or desired renovations, there are other costs in owning a vacation rental property. This would include insurance, utilities, maintenance, and property taxes.

Properties located within communities may have Homeowners’ Association (HOA) fees to cover maintenance of common areas like landscaping, or shared facilities such as a clubhouse, fitness center, or swimming pool.

In addition to this, there can be other fees that must be considered like leasehold or fee simple, which are essentially a “rental fee” or a charge imposed for the land upon which the property sits.

Unless you plan to handle the daily running of your rental, you might want to consider hiring a Property Management Company to assist with bookings, scheduling, and cleaning. Some states even require this as a part of ownership.

And don’t forget advertising. To get an edge above your competition, you may consider hiring a marketing firm to attract renters.

Understand short-term rental laws in your area.

Restrictions vary from one community to another. Check if your area limits the number of rental properties allowed, or if the owner must live on site or not. Some cities have length-of-stay laws, limiting guests to a maximum stay of 30 days. Other communities regulate the type of structure allowed as a rental or require owners to obtain a rental license.

If you plan on managing your vacation rental on your own, you’ll want to read up on your state and local government’s tax laws since some states require you to collect sales taxes or hotel taxes from your guests. Collecting and processing these taxes would be another step to consider when owning a vacation rental and managing it yourself.

These are just a few of the important factors you should pay attention to when determining if buying that vacation property is worth the investment or not.

Should you buy a vacation rental in 2020?

At the end of the day, this decision should be made after you do your homework on whether it’s right for you or not. There are some distinct opportunities in today’s market for some great deals on this type of investment property. But, it’s important to do your research quickly because eventually this crisis will end and when it does, the deals on vacation rentals might not be as advantageous as they are right now.

Do you have the right tools you need to find the best vacation property deals?

When it comes to real estate investing, having the right tools and systems can make all the difference in finding that beachfront property or mountain view property before your competition does.

If you’re looking to become a serious real estate investor who owns multiple properties including vacation rentals, you’ll need a plan for how you’ll find and locate your motivated sellers, and how you’ll manage leads.

Like with any business, it’s important to look at what industry experts and professionals are using to grow their businesses. It doesn’t make sense to spend time trying to do things manually and less efficiently when there are innovative systems and tools that can help you do things better and faster.

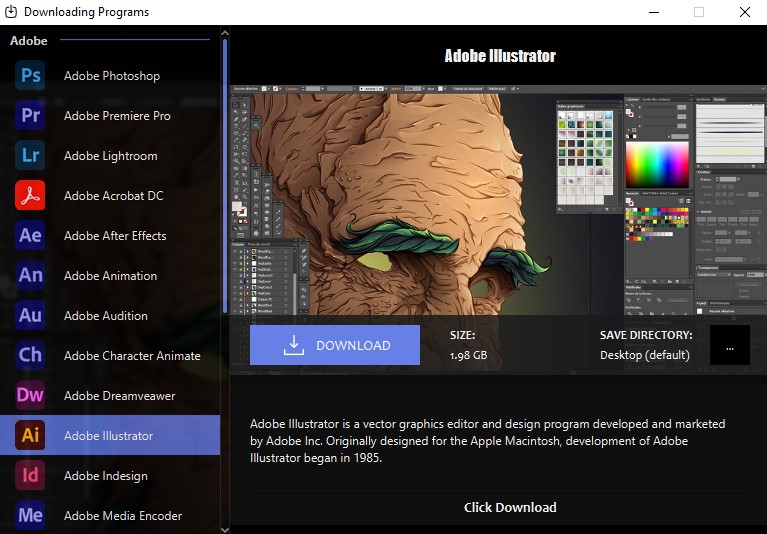

Here are some of the tools and systems we recommend:

Obtaining property lists is an important step in finding the right properties to fit your vacation rental needs, as well as to locate highly motivated sellers. Back in the day investors would use spreadsheets to manage these lead lists, but manual tracking and filtering just doesn’t make sense in 2020.

Now, you can save time and money by using a cloud-based property list stack filtering and fulfillment service like Property List Manager. This service helps you save both time and money by using the power of data and algorithms to import your lists, stack them, and then sort and filter the addresses to target your most highly motivated leads. With a built-in mapping system, PLM is an incredibly efficient way to streamline your property lists.

A Real Estate Investing CRM is another “must have” for managing your prospects, tracking leads and managing them, running personalized follow up and touchpoint campaigns, and handling every aspect of the sales life cycle. Our Grow CRM was built by real estate investors for real estate investors and allows you to manage every aspect of the sales life-cycle in one system with automated efficiency.

Finding motivated sellers and closing deals is a marathon, not a sprint. Investing in the right systems and software that help you optimize relationships and minimize time-consuming processes can make the difference between having a mediocre business and an amazing business.

For a limited time only, we’re running an unprecedented deal on both our Grow CRM and our Property List Manager together, making these systems more affordable than ever before.

Are you looking at a way to spend your coronavirus stimulus check?

If you’re still working right now and if you see your stimulus check as something that makes sense to invest, vacation rental properties might be the choice for you. Either way, this article has some ideas on what you can do to make your stimulus check go a little further.