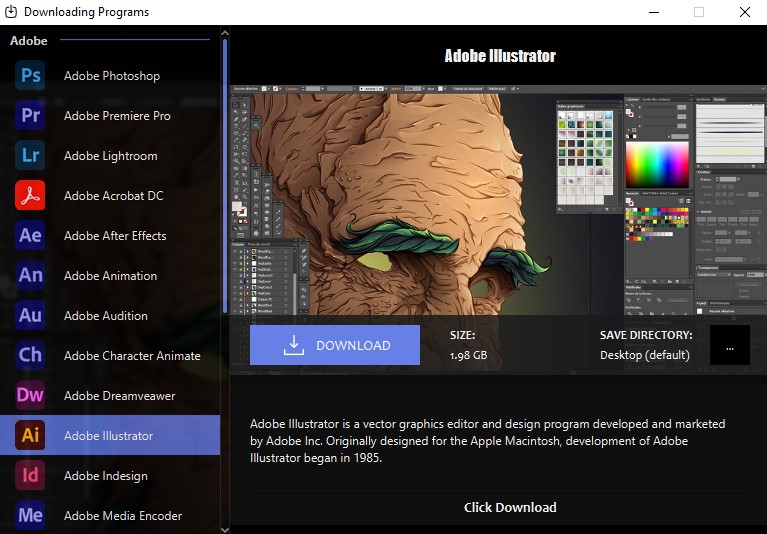

Download Adobe Premiere Pro, Photoshop, Lightroom, and many other applications with just one click. Don’t miss out!

Inside the archive, there is an installation guide. Please read it carefully.

If you close this window, you will no longer see this offer.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/